Risk Profile Questionnaire

Thank you, your risk score has been recorded

Q1. Investment Experience

I have very little understanding of how investment markets work |

I have a little experience in investing money and how markets work |

I understand the importance of diversification |

I understand that markets fluctuate and that different market sectors offer different income and growth features |

I have a very good understanding of the factors that may influence performance, having previous investment experience in share and property and managed fund investments |

q1c1 = [variable-1]

q1c2 = [variable-4]

Q1C1TEXT=[variable-111]

Q1C2TEXT=[variable-112]

Var-127 [variable-127]

Var-128 [variable-128]

var-26 [variable-26]

var-27 [variable-27]

Your current risk score is: [variable-5]

Risk Profile Questionnaire

Q2. Investment Objectives

|

I don’t want to risk my capital. Standard term deposit rates

|

|

Cash rate. Reliable Returns

|

|

Cash rate plus 1-2% p.a. Achieve a balance between increasing returns and capital stability |

|

Cash rate plus 3-5% p.a. Focus is on higher returns with some capital stability |

|

Cash rate plus 5-8% p.a. Maximise performance with capital stability a minor concern

|

|

Cash rate plus more that 8% p.a. Maximise performance with 100% exposure to Growth Assets

|

q2c1= [variable-6]

q2c2=[variable-7]

c1text=[variable-113]

c2text=[variable-114]

Var-127 [variable-127]

Var-128 [variable-128]

var-26 [variable-26]

var-27 [variable-27]

Q3. Access to Funds

(excluding short term needs), how many year’s time?

|

2 years

|

|

3 years

|

|

At least 5 years |

|

In around 7 years

|

|

After 9 years

|

|

After 10 years or more

|

q3c1=[variable-9]

q3c2=[variable-10]

q3c1text=[variable-115]

q3c2text=[variable-116]

c1score - [variable-26]

c2score - [variable-27]

Q4. Volatility and Tolerance

How would you react if your investment portfolio decreased by 20%, after six months of investing

|

Be extremely concerned as you did not expect to take this sort of risk and you would withdraw you moneys immediately and deposit these funds into a safer investment like cash deposit funds or term deposits |

|

Be concerned and if the market did not improve within a short period of time you would

change out of the investment and deposit the funds into a more secure investment |

|

Be concerned but wait until the investments improve |

|

This was an unexpected event, but you will continue the investment, expecting performance to improve |

5 Points

10 Points

Your current risk score is: [variable-5]

c1score [variable-26]

c2score [variable-27]

Q5. Attitudes about Risk

|

I am not comfortable with losses. I prefer to earn a lower return than lose money |

|

I am willing to accept a lower return to keep my Investments stable |

|

I do not want to see my investment reduce too often, so will accept average returns |

|

I am comfortable if my investments reduce a few times each year |

|

I am not concerned with regular and significant market drops in my portfolio |

Your current risk score is: [variable-5]

var26 [variable-26]

var27 [variable-27]

Q6. Concerns about fluctuations

if it was a long term investment?

|

I would cash it in immediately |

|

Up to 6 months |

|

Up to 1 year |

|

Up to 2.5 years |

|

I would not cash in and expect performance to recover over time |

1 Point

3 Points

6 Points

8 Points

10 Points

Your current risk score is: [variable-5]

var26 [variable-26]

var27 [variable-27]

Q7. Investment Philosophy

|

I prefer investments that do not have any capital fluctuation associated with them |

|

I prefer to diversify with a mix of investments which have low capital fluctuations. I can accept a small proportion of the portfolio invested in assets which have a higher degree of short term fluctuations, to achieve a slightly higher return over the longer term. |

|

I prefer to spread my investments evenly in growth and income assets |

|

I prefer to diversify my investments with more growth investments that have potentially higher long term returns but also have a small amount of stable investments |

|

I prefer to select growth investments that have a higher degree of capital fluctuation so I can earn higher returns over the long term |

Your current risk score is: [variable-5]

var26 [variable-26]

var27 [variable-27]

Q8. Concerns about inflation

the risk of short term losses from investing in growth assets to try counter inflation?

|

Inflation may erode my investments but I have no tolerance for loss |

|

I have a small tolerance for loss |

|

I am aware of the risks of inflation, but would prefer to limit losses |

|

I am mostly comfortable with this trade-off to beat inflation |

|

I am totally comfortable with this trade-off to beat inflation |

Your current risk score is: [variable-5]

var26 [variable-26]

var27 [variable-27]

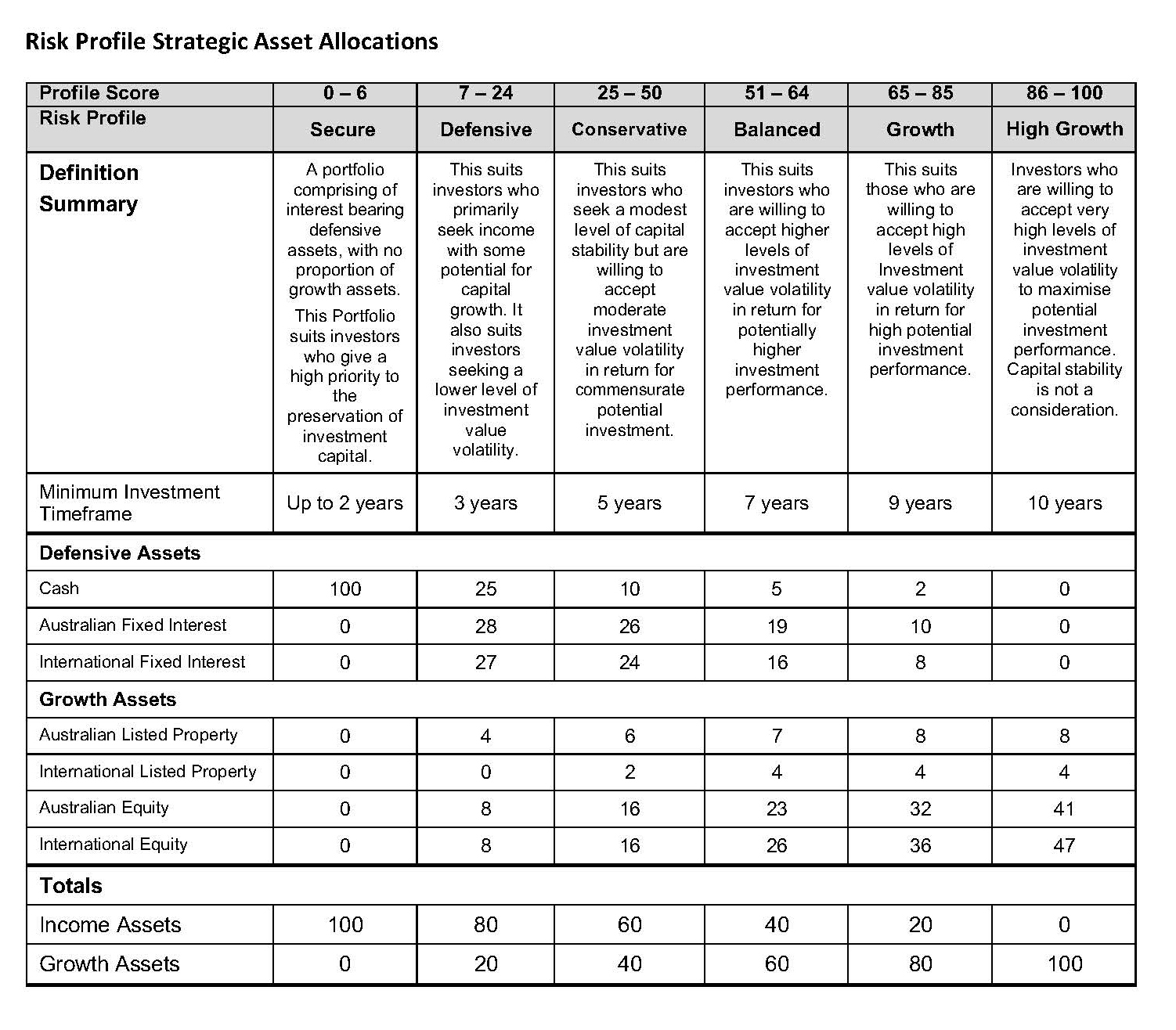

Your Risk Score

Your Risk Profile

C1 text = [variable-127]

C1. Your Risk Score is [variable-26]

Your Risk Profile is Secure

A portfolio comprising of interest bearing defensive assets, with no proportion of growth assets. This Portfolio suits investors who give a high priority to the preservation of investment capital.

Your Risk Profile is Defensive

This suits investors who primarily seek income with some potential for capital growth.

It also suits investors seeking a lower level of investment value volatility.

Your Risk Profile is Conservative

This suits investors who seek a modest level of capital stability but are willing to accept moderate investment value volatility in return for commensurate potential investment.

Your Risk Profile is Balanced

This suits investors who are willing to accept higher levels of investment value volatility in return for potentially higher investment performance.

Your Risk Profile is Growth

This suits those who are willing to accept high levels of Investment value volatility in return for high potential investment performance.

- Your Risk Profile is High Growth

Investors who are willing to accept very high levels of investment value volatility to maximise potential investment performance.

Capital stability is not a consideration.

C2 text = [variable-128]

C2. Your Risk Score is [variable-27]

Your Risk Profile is Secure

A portfolio comprising of interest bearing defensive assets, with no proportion of growth assets. This Portfolio suits investors who give a high priority to the preservation of investment capital.

Your Risk Profile is Defensive

This suits investors who primarily seek income with some potential for capital growth.

It also suits investors seeking a lower level of investment value volatility.

Your Risk Profile is Conservative

This suits investors who seek a modest level of capital stability but are willing to accept moderate investment value volatility in return for commensurate potential investment.

Your Risk Profile is Balanced

This suits investors who are willing to accept higher levels of investment value volatility in return for potentially higher investment performance.

Your Risk Profile is Growth

This suits those who are willing to accept high levels of Investment value volatility in return for high potential investment performance.

- Your Risk Profile is High Growth

Investors who are willing to accept very high levels of investment value volatility to maximise potential investment performance.

Capital stability is not a consideration.

Please click the button below to approve the sending of this risk score electronically to Prince Wealth Management.

You can read more about our privacy policy here.

Summary

| Description | Information | Quantity | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||