Donald Trump has always seen the stock market as a barometer of success—his own and the country’s. During his presidency, he regularly touted record highs in the Dow Jones and S&P 500 as evidence of effective leadership. One thing seems clear: if Trump wants to leave a lasting legacy, he has every reason to avoid a prolonged market crash.

Trump’s personal brand—built on winning, economic strength, and “America First” prosperity—is tightly intertwined with how the markets perform. A sharp, sustained downturn would not only damage investor confidence but undercut the economic narrative he’s worked hard to build.

From Fear to Recovery: A Look at 2025 Markets

Earlier this year, equities faced a wave of pessimism. Inflation remained stubborn, interest rates were high, and recession fears loomed. The S&P 500 dropped below 4,600 in February, while the tech-heavy Nasdaq briefly dipped under 14,000.

Yet markets have rebounded impressively. As of mid-May:

- S&P 500 is trading over 5,900

- Nasdaq has climbed past 19,000

- In Australia, the ASX 200 is trading over 8,000

Leading the recovery have been mega-cap tech stocks and resilient consumer names:

- Nvidia (NVDA) surged on continued AI-driven optimism and stellar earnings.

- Meta (META) and Microsoft (MSFT) bounced back strongly after early-year sell-offs, thanks to steady growth in cloud and services.

- Amazon (AMZN) recovered after cutting costs and improving margins in its core e-commerce business.

- Tesla (TSLA), after a rocky Q1, found renewed momentum with global EV delivery growth and progress in energy storage.

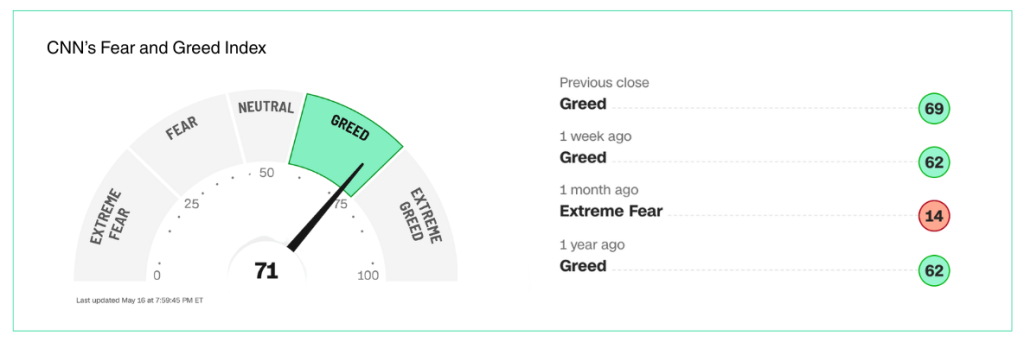

This swift recovery reflects more than just corporate strength—it’s a signal that investor sentiment remains anchored in the belief that the worst is behind us.

Why Trump Doesn’t Want a Crash

If Trump maintains political influence or stages a return to office, he’ll almost certainly lean into economic themes: tax cuts, deregulation, energy independence, and supply chain “reshoring.” All of these tend to boost market confidence—at least in the short term.

But crucially, Trump knows that if he becomes associated with a market crash, his narrative of prosperity and strength takes a major hit. Consider:

- Public perception: A downturn damages his “CEO of America” image.

- Voter confidence: Financial pain among retirees and retail investors could cost him swing votes.

- Historical standing: Presidents are often judged economically. Trump won’t want to join the ranks of leaders whose terms ended in recessions or market collapses.

He has every reason, therefore, to avoid market chaos. That means less appetite for trade wars, erratic policy shifts, or regulatory uncertainty that could rattle Wall Street.

Economic Positioning: What the Market Expects

Markets are forward-looking, and investors appear to be pricing in a relatively market-friendly environment under Trump’s continued influence. Here’s why:

- Lower Rate Outlook: With inflation softening, the Federal Reserve has signalled potential rate cuts in late 2025. Trump would likely support an accommodative Federal Reserve, putting further upward pressure on equities.

- Energy Sector Tailwinds: A Trump agenda would favor traditional energy companies. Watch ExxonMobil (XOM) and Chevron (CVX) if rhetoric around U.S. drilling and pipelines intensifies.

- Defense & Infrastructure: Increased spending on defense (think Lockheed Martin [LMT]) and U.S.-focused manufacturing infrastructure could be back in focus under a Trump policy revival.

Still, risks remain. If Trump’s rhetoric turns too aggressive—particularly on China, tech regulation, or immigration—volatility could return.

Investor Takeaway

Love him or hate him, Trump remains a market-sensitive figure. If he seeks to enchance his legacy with an image of economic prosperity, keeping markets afloat—or rising—will be a top priority.

With the major indices rebounding sharply, confidence is gradually returning. Investors are betting that policy, earnings, and sentiment are aligning to support further growth.

For now, the Trump-market relationship is a stabilising force rather than a disruptive one. His focus on legacy means he’ll likely advocate for policies that benefit equities, business sentiment, and investor returns.

In Summary

- Markets are recovering fast from early 2025 lows, led by tech and consumer strength.

- Trump’s legacy is linked to market performance, giving him strong motivation to avoid a crash.

- Investors are watching closely for signs that Trump’s rhetoric will stay pro-market rather than trigger fresh volatility.

Tony Raikes

CPA. B.Acc Dip.FP Grad.Cert.Mgt

Private Client Advisor

Authorised Representative No. 00448193

Prince Wealth Founder and Financial Adviser Tony Raikes utilises a variety of advanced risk management strategies to protect clients’ portfolios and is dedicated to providing a comprehensive financial planning experience, empowering clients to make confident and informed decisions about their financial future.